Biggest altcoin Ether (ETH) built on its current all-time high up on Feb. 5 to climb ever closer to $2,000.

Ether rate strikes document $1,750.

Information from Cointelegraph Markets as well as TradingView showed a fresh breakout taking place for ETH/USD during Friday trading.

At the time of creating, Ether was targeting $1,750 as 6.5% everyday gains covered weekly returns of nearly 22%.

The relocation came on the rear of intense trading passion in DeFi coins, many of which use the Ethereum network as their basis. DeFi produced much of the very best moving companies on once a week durations.

Ether at the same time had already seen brisk upside as anticipation developed over the launch of specialized futures from CME Team, one of the pioneering Bitcoin futures operators. Property management giant Grayscale began purchasing ETH for its Ether Trust once again this week after a near two-month break.

Gas fees create migraines.

While some well-known cryptocurrency numbers, consisting of Gemini exchange co-founder Tyler Winklevoss, commemorated cost performance, the highs were accompanied by an additional record– purchase charges.

As Cointelegraph reported, gas charges on the Ethereum network became so high today that some exchanges were forced to halt ETH withdrawals altogether.

” This is a legitimate dilemma. Going to need to stock up on snacks to see exactly how Ethereum digs its escape of this,” Blockstream developer Grubles commented.

According to information from YCharts, the average ETH cost was $23.27 on Feb. 4, the most up to date day for which data were offered.

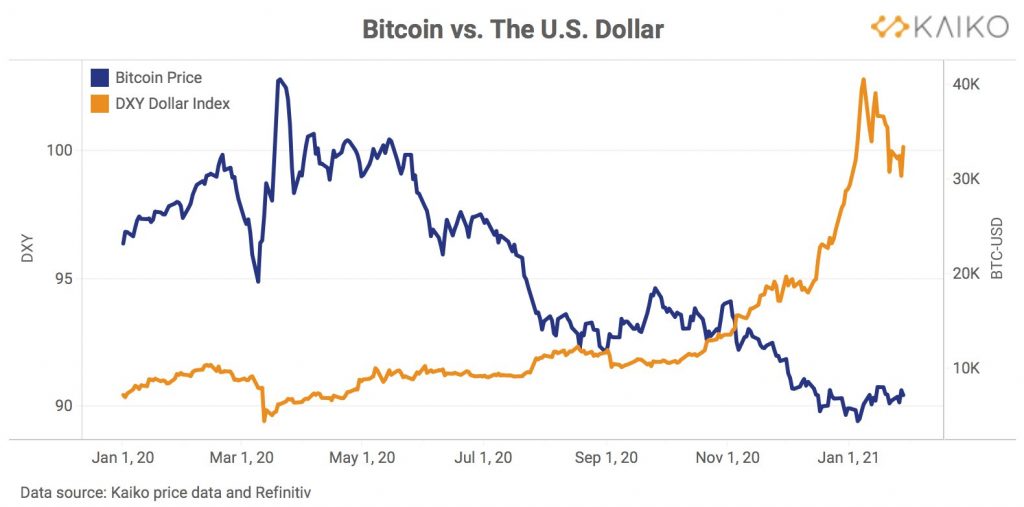

While Bitcoin (BTC) on the other hand simmered below $40,000, macro conditions showed up suitable to fuel fresh benefit for BTC/USD. As the S&P 500 hit its very own all-time high up on Friday, so the U.S. buck currency index decrease, a phenomenon which generally implies that Bitcoin will benefit.

” Correlation is not causation, but the trend is fairly clear: #Bitcoin’s meteoric rate surge (and also occasional accidents) correlates very closely with activities of the UNITED STATE Buck Index (DXY),” data analytics solution Kaiko wrote about the phenomenon today.